With the beginning of China's reform and opening-up, a lot of new problems arose in foreign exchange administration in the following aspects: (1) with more and more foreigners, overseas Chinese and compatriots from Hong Kong and Macau coming to China's mainland, more foreign currencies flew in, posing difficulty to foreign currency administration; (2) foreign currencies widely circulating in some coastal cities caused disorders; (3) in some stores specially for foreigners and overseas Chinese, there were scarce commodities much needed on the market, attracting purchase by domestic residents and thus resulting in profit-seeking fraudulent purchase and price fluctuation.

In order to strengthen foreign exchange administration, prohibit the circulation of foreign currencies and maintain the socialist financial orders, according to the status of the reform and opening-up and certain practices of foreign countries, the State Council decided to authorize Bank of China to issue foreign exchange certificates from April 1, 1980.

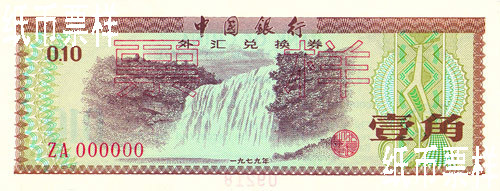

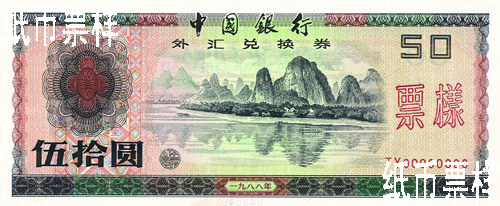

Foreign exchange certificate was a RMB certificate with exchange value rather than a currency, which could only be used as a payment instrument within a specified scope for the equivalent value of RMB. In March, 1980, Bank of China formulated Provisional Regulations of Bank of China on Administration of Foreign Exchange Certificates, specifying that: the par value of the foreign exchange certificates is divided into 100 yuan, 50 yuan, 10 yuan, 5 yuan, 1 yuan, 0.5 yuan and 0.1 yuan of RMB unit; foreigners of short-term stay in Chinese Mainland must use foreign exchange certificates to buy specified goods. When foreigners used the foreign exchange certificates in exchange for foreign currencies at the designated foreign currency exchange outlets, Bank of China would issue an "Exchange Certification" to them, with which the customers could redeposit the foreign exchange certificates they held as special type of RMB deposits or foreign currency deposits and the like with Bank of China within six months.

Foreign Exchange Certificate Issued by Bank of China (Version 1979)

Foreign Exchange Certificate Issued by Bank of China (Version 1988)

The foreign exchange certificates adapted to the needs of the reform and opening-up. From 1980 to 1989, the accumulative value of the foreign exchange certificates issued reached RMB 31 billion, of which approximately RMB 4.1 billion were circulating on the market. Foreign exchange certificates not only offered facilities to foreign tourists, but helped increase nontrade foreign exchange revenue and facilitated the calculation of foreign exchange retention, thus combating foreign exchange evasion and arbitrage as well as black market deals. On the whole, the foreign exchange certificates were as effective as expectation.

However, a few regions encountered some problems due to lack of experience and management. For instance, in Guangdong, Shenzhen, Zhuhai and some other places, some stores sold the same commodity with three price tags in HKD, foreign exchange certificates and RMB respectively, but RMB was often snubbed by customers because the foreign exchange certificates were not equivalent to RMB. Sometimes the eligible users of foreign exchange certificates and the scope of use didn't comply with applicable regulations, giving rise to black market of foreign exchange certificates and foreign exchange evasion and arbitrage. In order to solve these problems, relevant authorities set up a special team to carry out extensive and in-depth investigations in many places for two months. After finding the problems, the team submitted a Report on Strengthening the Administration of Foreign Exchange Certificates. Subsequently, with a series of rigorous measures taken, the administration of foreign exchange certificates was improved.

|