In 1978, Bank of China became an agent for credit cards issued by foreign financial institutions, dealing with payment services for foreign credit cards and traveler's cheques. This was the mark of the entry of credit cards into China's mainland. Bank of China took the lead in issuing credit cards in China in 1985.

Conforming to the demand of reform and opening-up, Bank of China took the lead in introducing credit card business by entering into agreements on credit card-based cash withdrawal and consumption with world famous banks and financial institutions successively. During the period from 1981 to 1983, it signed an agreement on commissioned issuance of Federal Card with Hong Kong Nanyang Commercial Bank, an agreement on commissioned issuance of American Express Card for payment of personal cheques with Hong Kong American Express, an agreement on commissioned issuance of Million credit card with Tokai Bank of Japan and Million Credit Card Service Company, an agreement on commissioned issuance of Visa card and MasterCard with Bank of East Asia and HSBC, an agreement on accepting JCB credit card with Japan JCB International Company and Japan Sanwa Bank, and an agreement on commissioned issuance of Diners Card with Citibank.

Bank of China joined the MasterCard and Visa international organizations in 1987. As the first bank joining the two major credit card international organizations in China, Bank of China was expected to undertake the responsibility of domestic receipt acquisition and settlement so as to earn more foreign exchange for the country. Therefore, it tried to handle settlement of MasterCard and Visa from 1991 and was technically verified and accepted by both of the international organizations. In May 1992, it started the settlement for small amount of credit card receipts. In July, the Credit Card Operation Center of Bank of China was established to deal with acquiring and settlement of MasterCard and Visa International Card, changing the previous scenario that receipts of commissioned foreign credit cards could only be settled in Hong Kong.

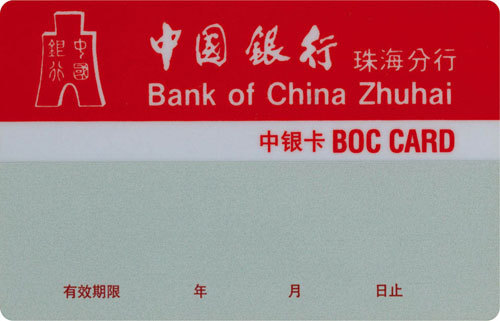

Bank of China Zhuhai Branch took the lead in launching the first RMB credit card in China - "Bank of China Card" - in March 1985. However, it was not widely used due to small issuance.

The first RMB credit card in China

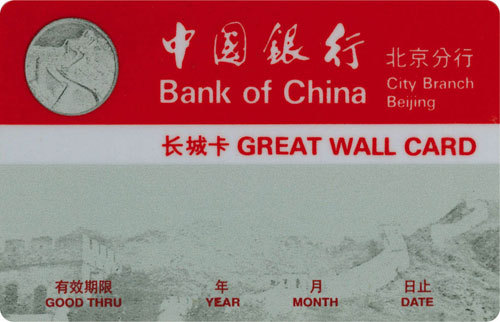

In May 1986, Bank of China Beijing Branch applied to the head office for issuance of Great Wall Card. The Head office approved and decided to use "Great Wall Card" as the only credit card brand in the entire Bank of China system and to carry out trial issuance in Beijing. In October of the same year, Great Wall Card was promoted throughout China. In 1987 alone, 12,000 Great Wall cards were issued, taking a deposit of RMB 200 million.

The first Great Wall Card issued by Bank of China

Aware of the importance of computer communication facilities in credit card business, Bank of China has input substantial resources to build computer communication infrastructure since the beginning of credit card business. In 1992, a regional ATM network was established among Guangdong provincial branch, Guangzhou Branch, Shenzhen Branch, Shantou Branch and Dongguan Branch, paving the way for nationwide ATM interconnection for Bank of China.

The first batch of ATMs was put into use in Bank of China Zhuhai Branch and its three sub-branches in 1987.

In September 1992, with the issuance of the Great Wall credit card in Lhasa by Bank of China Tibet Branch, Great Wall Card became the first credit card issued throughout the country. By the end of 1992, Great Wall Card had grown into a series of cards including standard card, gold card, foreign exchange card, Great Wall-Visa card and ATM cash withdrawal card issued by 310 branches and sub-branches. Meanwhile, Great Wall Card was accepted by 11,233 partner merchants, 6.8 times of 1,638 in 1988; a total of 606,300 cards were issued, 13.6 times of 44,500 in 1988; and the transaction volume reached RMB 41.4 billion, 103.5 times of 400 million in 1988.

Development of Bank of China's credit card business had a positive effect in many aspects: increased sources of deposit; increased business categories and reduced cash circulation, which better served the development of socialist commodity economy; increased foreign exchange revenue thanks to promotion of domestic tourism industry; and promoted reform of domestic traditional settlement method by exploring a settlement system backed by cheque, draft, promissory note and credit card.

|